In a recent interview on Premarket Prep with hosts Dennis Dick and Joel Elconin, Eric Krull, co-author of The Lifecycle Trade, shared his analysis on the current state of the IPO market, standout performers, and what lies ahead. With a wealth of experience in market trends, Krull offered a nuanced perspective on how IPOs are shaping up in 2025 and what traders and investors should watch for.

A Resurgent IPO Market

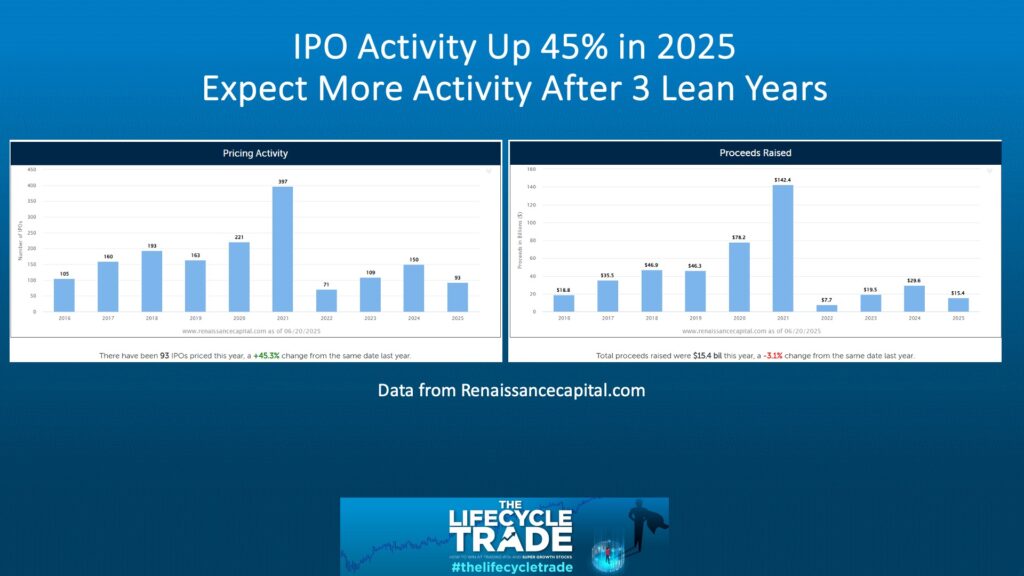

Krull kicked off by highlighting a notable pickup in IPO activity. Compared to the previous year, the number of IPOs has increased, though the total capital raised remains lower, pointing to smaller-sized offerings. He views this trend as a positive signal for the broader market, suggesting that a moderate increase in IPOs reflects healthy growth rather than speculative excess. “Until we start seeing 300 or 400 IPOs, I don’t think we’re looking at frothy yet,” Krull noted, contrasting the current pace with the frenetic spike of 2021.

Standout IPOs: CoreWeave, Circle, and Reddit

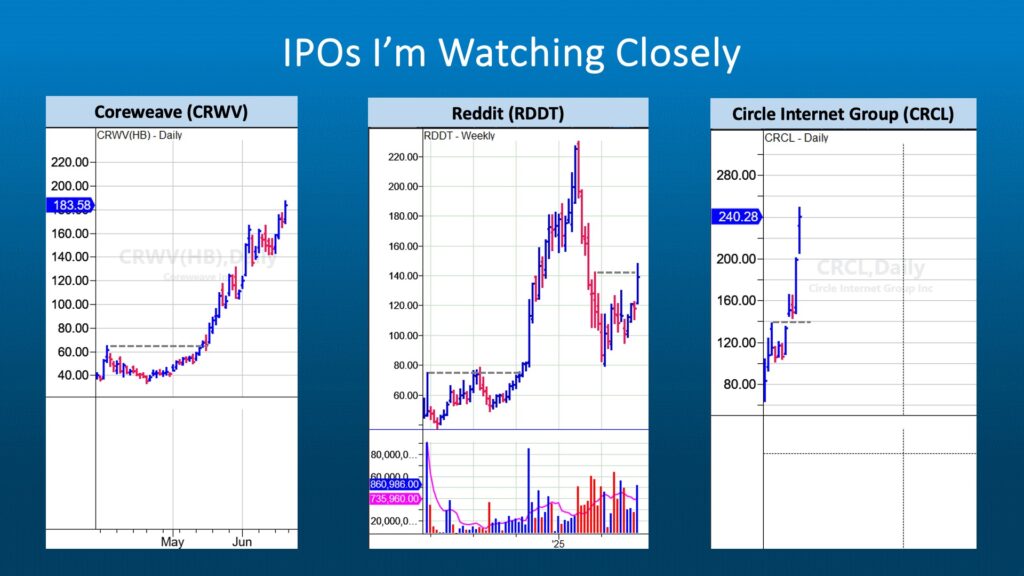

The discussion turned to some of the best-performing IPOs since January 2024, with Krull spotlighting CoreWeave, Circle Internet Group, and Reddit.

- CoreWeave (NASDAQ: CRWV): This AI-driven company has been a standout, with its stock soaring from $35 to $246 in just 10 days. Krull attributes this to the “feeding frenzy” around AI and hot industries, likening it to early internet giants like eBay. He labels it a “rare jewel” (an IPO gaining over 100% in its first 90 days) a feat achieved by only 5-6% of IPOs.

- Circle Internet Group (NYSE: CRCL): Another “rare jewel,” Circle followed a classic IPO pattern: an initial surge, a pullback, a base formation, and then a breakout. Krull emphasized its exceptional performance, doubling in value shortly after pricing, but cautioned that such rocket ships often face sharp pullbacks. He advocates for “fast sell rules,” like selling half if the stock dips 3% below the 21-day EMA, to manage risk.

- Reddit (NYSE: RDDT): Krull outlined Reddit’s journey through an IPO surge, consolidation, a strong run, and a subsequent correction. Now, he says, it’s in a “prove it” phase where earnings will determine its next move. Unlike newer IPOs riding hype, Reddit must demonstrate financial substance to sustain investor interest.

Navigating High Flyers: Rare Jewels and Fast Sell Rules

Krull’s concept of “rare jewels” underscores the rarity and volatility of IPOs like CoreWeave and Circle. While their rapid gains are enticing, he warns of historical precedents like Amazon.com seeing 90% pullbacks after early surges. To protect gains, he recommends disciplined strategies, such as trailing stops based on recent lows or the “Everest rule,” which tracks consecutive up days and gaps to signal potential reversals.

Insider Sales and Lockup Periods

On insider sales, Krull takes a pragmatic stance. He doesn’t focus on them, as executives may sell for personal reasons unrelated to company health. However, he keeps an eye on lockup periods (typically six months to a year post-IPO) when stocks can face turbulence as insiders and early investors cash out.

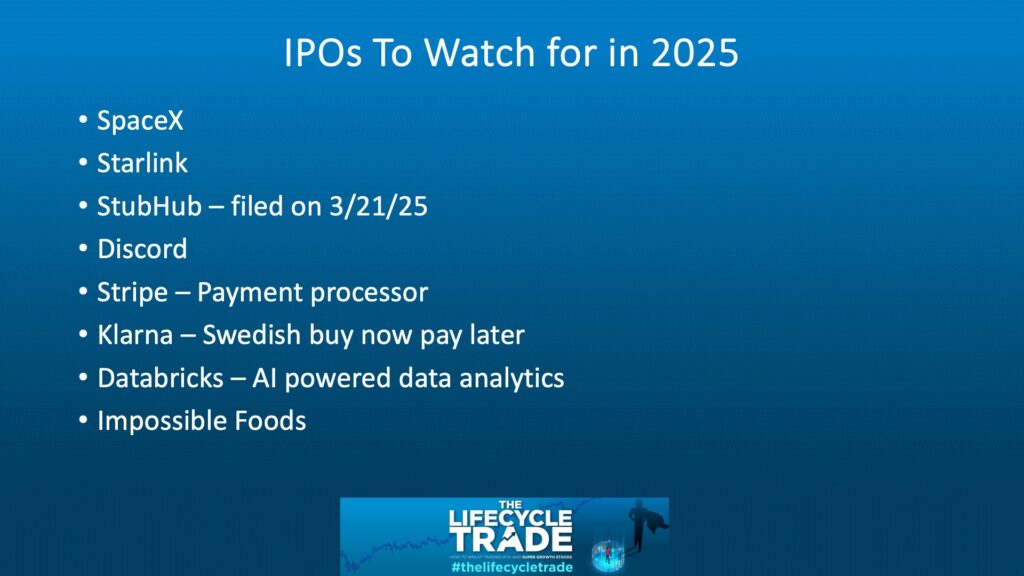

IPOs on the Horizon

Looking ahead, Krull flagged several anticipated IPOs: StubHub, SpaceX, Starlink, Discord and others. He’s particularly excited about SpaceX and Starlink, citing their lack of competition and strong public recognition. “It’s usually the ones that have a lot of presence,” he said, noting that retail darlings often see the biggest moves. StubHub, while filed, has been slow to launch, and Krull expressed skepticism about Impossible Foods, suggesting it missed its window amid waning interest in meat alternatives.

Macro Environment: Resilience Amid Uncertainty

Krull believes the IPO market is adapting to the current macro landscape. While geopolitical events such as the Iran-related tensions, we might briefly see slower activity. In the medium and longer term, he sees the market as resilient to steady interest rates and political noise. “As we settle down, I think the IPO market heats up,” he predicted, pointing to the success of recent IPOs as evidence of enduring demand.

SPACs: A Warning Sign

Reflecting on the 2021 SPAC boom, Krull recalled how 450 SPACs joined nearly 400 traditional IPOs, only for most to falter. He views a potential SPAC resurgence with caution. “If the SPACs market heats up again… that’s a sign of frothiness,” he warned, citing their poor track record and the lower quality of companies typically involved. Exceptions like DraftKings aside, he hopes SPACs don’t overshadow the IPO recovery.

Conclusion

Eric Krull’s analysis paints an optimistic yet cautious picture of the IPO market in 2025. With activity on the rise, standout performers capturing attention, and big names on the horizon, he sees opportunity, but stresses vigilance. For investors, his insights underscore the importance of timing, discipline, and a keen eye on earnings and market signals. As the market evolves, Krull’s perspective offers a roadmap for navigating the highs and lows of IPO investing.

*image credits: Eric Krull

For more articles like these, education and much more, join the Stock Trader Network here.